Sometime last year, I started meticulously tracking my spending. I saved all my receipts and kept all of my financials updated in an organized Excel workbook. And then sometime around May of this year, I stopped tracking everything and, consequently, my spending has gone to crap.

I’m going to try and post a monthly review of my finances to keep myself accountable. Who knows, maybe I won’t buy a shake once a week from the diner down the street knowing that I’ll have to fess up to you all.

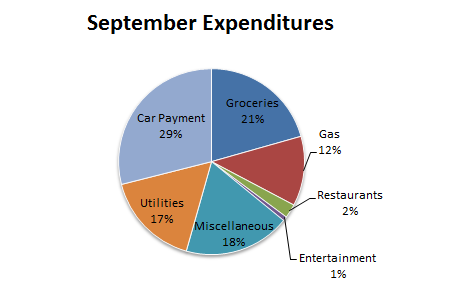

Breakdown of my spending this month:

- Groceries: $136. This was my weak point this month and I’m not even really sure how I spent this much. I know that part of it was the fact that I moved back this month and had to buy a lot of necessities that I don’t normally need to buy on a regular basis (salt, pepper, flour, etc.). A lot of this was also impulse spending: I went grocery shopping with Andrew and his roommate so I bought a lot of unnecessary things for them and myself that I wouldn’t normally buy. Peer pressure, y’all.

- Gas: $80. Not terrible. There’s also not a lot that I can do to cut back on this short of taking public transportation. I have been walking to school, so maybe next month I can shave a little bit off of that.

- Restaurants: $16. I did really well this month on eating out. I only went out on two occasions and spent a minimal amount ($8 each time).

- Entertainment: $5. This was also a high point this month for me; I went to the movies and only bought candy for me and Andrew. Success.

- Miscellaneous: $122. Another rough area this month – and all spent at Walmart! A lot of this was a one-time expense, though. Since my roommate moved out, I needed to buy a lot of cleaning supplies and kitchenware, including broom and dust pan, toilet plunger and brush, knives, organizational crates, and toiletries. I should be able to eliminate most of these expenses for the month of October.

- Utilities: $110. This includes internet, gas, and electric bills. This also includes installation fees and set-up charges. This should be marginally lower next month.

Total Expenditures: $469*

Areas for improvement are definitely my groceries and miscellaneous spending. My goal is to cut each by about $50, which would still leave me with $86 for groceries and $72 for miscellaneous. I’m going to put that $100 directly into savings, which has been suffering these last few months with wedding planning. Living on your own can be expensive, but it doesn’t have to be when you’re wise with your money. So here’s to better finances in October!

*Note: I haven’t included my fixed costs (such as rent and car payments) because these costs I can’t change or diminish, so are, in this case, irrelevant.

I used to track my spending on Mint, but I also fell out of the wagon earlier this year. I’m still managing my spending albeit differently. We just moved across the country so the last few months haven’t been that great for me financially. Now that we’ve settled in though, hopefully our spending has stabilized.

Sounds like your spending this month was for necessary items so good job! Moving is always expensive so you have to plan for it.

I used to the same thing and track my expenses in Excel. You did awesome on your restaurants and entertainment expenses! When I tracked mine, my highest was always restaurants, groceries, and gas. Like you said, there wasn’t much I could cut back on gas. I have to drive to work every day since it’s not walking distance. I usually didn’t mind if my grocery expenses were higher because that meant I ate out less.

Good luck on your goal of cutting groceries and miscellaneous by $50! Sounds like October’s expenses should be lower without things like installation fees and new supplies

Very proactive, and it great that you have this information to look back on! It is smart to keep track and evaluate your expenses so you can be informed and make changed, when necessary. I think it is a good idea to track this on your blog as well.. This creates another backup of the information and puts your spending habits out there so that you can perhaps be more accountable, and also possibly get advice and/or encouragement from your readers.

I also generally spend most of my money on food.