Sometime last year, I started meticulously tracking my spending. I saved all my receipts and kept all of my financials updated in an organized Excel workbook. And then sometime around May of this year, I stopped tracking everything and, consequently, my spending has gone to crap.

I’m going to try and post a monthly review of my finances to keep myself accountable. Who knows, maybe I won’t buy a shake once a week from the diner down the street knowing that I’ll have to fess up to you all.

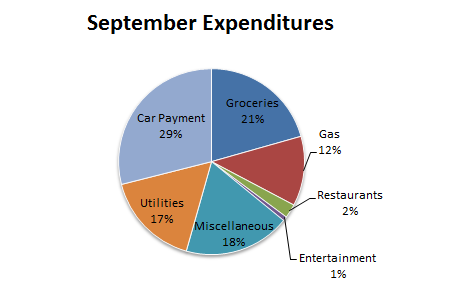

Breakdown of my spending this month:

- Groceries: $136. This was my weak point this month and I’m not even really sure how I spent this much. I know that part of it was the fact that I moved back this month and had to buy a lot of necessities that I don’t normally need to buy on a regular basis (salt, pepper, flour, etc.). A lot of this was also impulse spending: I went grocery shopping with Andrew and his roommate so I bought a lot of unnecessary things for them and myself that I wouldn’t normally buy. Peer pressure, y’all.

- Gas: $80. Not terrible. There’s also not a lot that I can do to cut back on this short of taking public transportation. I have been walking to school, so maybe next month I can shave a little bit off of that.

- Restaurants: $16. I did really well this month on eating out. I only went out on two occasions and spent a minimal amount ($8 each time).

- Entertainment: $5. This was also a high point this month for me; I went to the movies and only bought candy for me and Andrew. Success.

- Miscellaneous: $122. Another rough area this month – and all spent at Walmart! A lot of this was a one-time expense, though. Since my roommate moved out, I needed to buy a lot of cleaning supplies and kitchenware, including broom and dust pan, toilet plunger and brush, knives, organizational crates, and toiletries. I should be able to eliminate most of these expenses for the month of October.

- Utilities: $110. This includes internet, gas, and electric bills. This also includes installation fees and set-up charges. This should be marginally lower next month.

Total Expenditures: $469*

Areas for improvement are definitely my groceries and miscellaneous spending. My goal is to cut each by about $50, which would still leave me with $86 for groceries and $72 for miscellaneous. I’m going to put that $100 directly into savings, which has been suffering these last few months with wedding planning. Living on your own can be expensive, but it doesn’t have to be when you’re wise with your money. So here’s to better finances in October!

*Note: I haven’t included my fixed costs (such as rent and car payments) because these costs I can’t change or diminish, so are, in this case, irrelevant.